Alumni Ventures

Your Venture Capital Partner

See video policy below.

About Alumni Ventures

We are a venture capital firm that provides accredited investors & institutions with access to professionally-managed, diversified venture portfolios. Our network is among the largest and most well-connected in the industry.

- Home#1 most active venture firm in the U.S., #3 in the world (PitchBook '22 & '23)

- Home$1.25B+ capital raised since founding in 2014

- HomeDiversified portfolio of 1,300+ venture-backed companies, adding ~250 / year

- Home10,000 individual accredited investors already trust us with their venture investing

- HomeTop 20 Venture Firm (CB Insights '24)

- HomeTop-quartile performance

- HomeNetwork of 625K investors, entrepreneurs, & community members

- Home5 national offices & ~40 full-time venture investors

Why VC May Belong in Your Portfolio

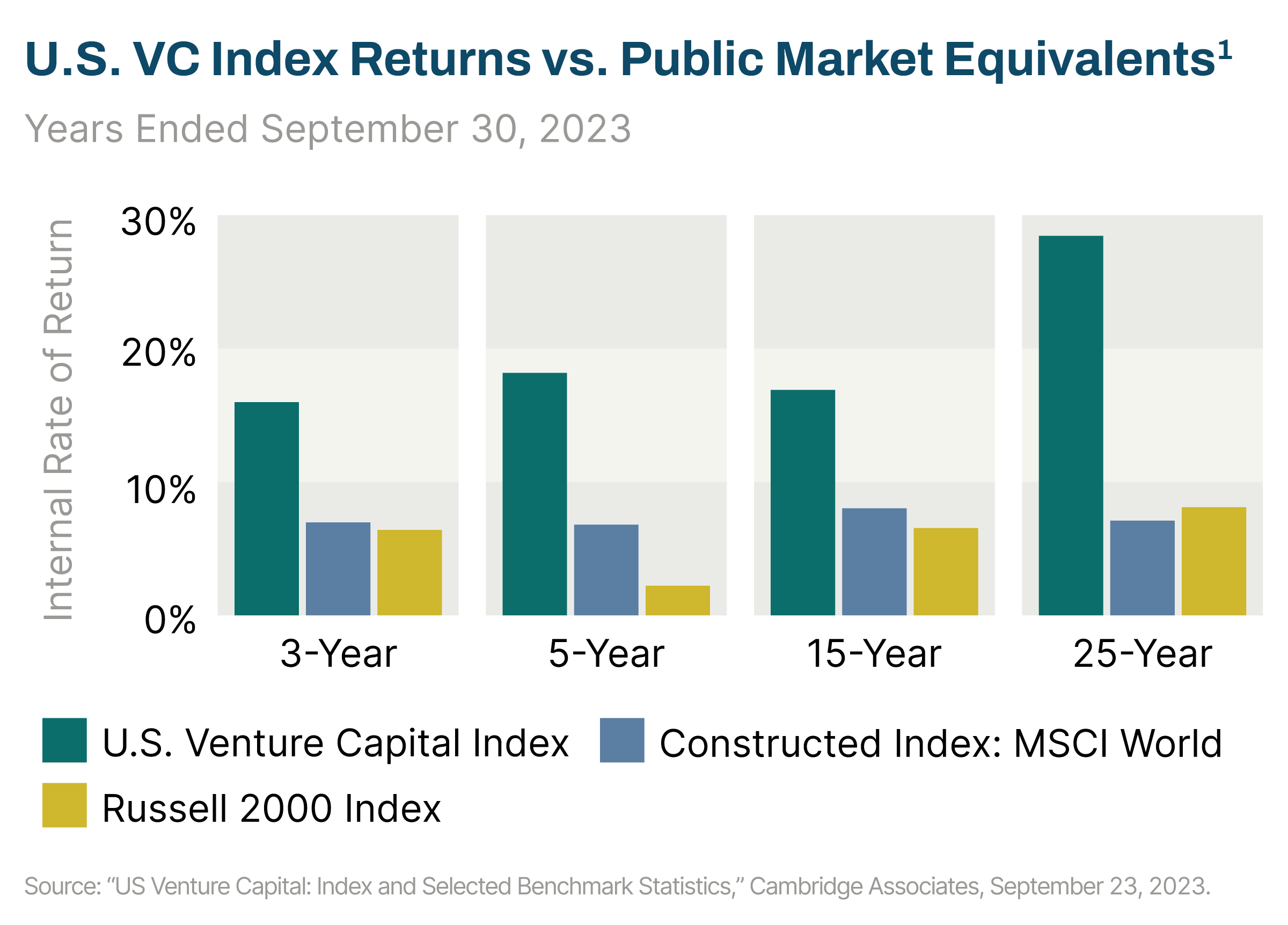

- HomeVC has outperformed the public market equivalents over the past 5, 15, and 25 years.

- HomeVC has been the top-performing alternative asset class over the last decade.

- HomeVC is largely uncorrelated to the public markets, making it attractive from a portfolio risk-mitigation perspective.

- HomeMore value is being created in the private markets than ever before, and the largest endowments and institutions are increasing allocations here.

Sources for the above claims

Book a Private Intro Call

Quick & Easy. 15 Minutes.

Get to Know Us

- Home

Human

Yes, we are a bit nerdy and love thinking about the future. But we are also relatable “I’d have a beer with them” people who are happy to answer questions or just chat. - Home

Experienced

Our team has hundreds of years combined in accessing promising venture deals. - Home

Transparent

We’ll be open and honest with you. At the bottom of this page are seven very good questions we are asked a lot.

Investment Strategy

We believe in diversification, investing alongside established lead investors, and running a disciplined and rigorous process.

- Home1

Our network helps us source, vet, and access great venture deals.

- Home2

Our team of ~40 full-time investment professionals work to win allocation into the most competitive venture deals.

- Home3

Our rigorous and disciplined processes provide our investors with smart, simple venture capital portfolios.

Our Secret Sauce

Alumni Ventures is a network-powered VC firm. Our community is our source of capital, expertise, and how we add value to our portfolio companies.

A Venture Fund for Every Objective

Foundational Funds

- Home

~20-30 investments diversified by stage, sector, geography, and lead investor

- Home

Investments sourced by our entire team of ~40 full-time venture investment professionals

- Home

Co-investing alongside other established venture firms

- Home

Portfolio constructed by our Office of the CIO, with 20% reserved for follow-ons

- Home

Includes access to deal Syndications and engagement opportunities with other investors

Typical Investments are $50k-$100k

Minimum is $25k

Focused Funds

- Home

Diversified portfolios, deploying against specific strategy, with reserves for follow-ons

- Home

Investments sourced by our entire team of ~40 full-time venture investment professionals

- Home

Co-investing alongside other established venture firms

- Home

Each Focused Fund is led by dedicated full-time team with specific thematic expertise

- Home

Includes access to deal Syndications and engagement opportunities with other investors

Typical Investments are $50k-$100k

Minimums start at $25k

Syndications

- Home

Opportunities to invest in single venture deals.

- Home

Only for existing AV fund investors

- Home

All deals sourced by our investment professionals and invested in by one or more of our funds

- Home

Deal diligence materials shared via a secure data room

- Home

You decide how often you want to see Syndications and whether or not to invest

Typical Investments are $15-25k

Minimum is $10k

Frequently Asked Questions

FAQ

There are many reasons to consider venture capital. Here are five that make a strong argument.

Returns: Venture capital is an asset class that has outperformed the S&P over many periods.1

Portfolio diversification: Since VC returns are not correlated to the stock market, a venture portfolio is a way to diversify your overall portfolio.2 AV offers venture portfolios diversified by sector, stage, region, and lead investors.

Staying private longer: Fewer companies are going public than in prior periods3—and many that do already have significant value creation behind them.4

Impact: Many of the companies our funds invest in are tackling society’s toughest challenges in health, energy, finance, transportation, and more. Investing in VC is fundamentally an optimistic statement that the future can be better. Several of our Focused Funds address impact even more directly.

Learning: Most of our investors are naturally curious people, looking to learn and understand what is new and what is next.

(1) Maureen Austin, David Thurston, William Prout, “Building Winning Portfolios Through Private Investments,” Cambridge Associates, August 2021. Data is from 12/31/2020., (2) Invesco, “The Case for Venture Capital,” Invesco White Paper Series, accessed January 11, 2022 (showing venture capital performance uncorrelated to large-cap equities), (3) Invesco, “The Case for Venture Capital,” Invesco White Paper Series, accessed January 11, 2022, (4) Anna Zakrzewski et al., “The Future is Private: Unlocking the Art of Private Equity in Wealth Management,” BCG, March 2022. 4. Jason Thomas, “Global Insights Reflections on the Revolution in Finance,” Carlyle, February 8, 2021

Alumni Ventures is a distinguished and reputable player in the venture capital industry and offers accredited individuals access to professional-grade venture capital. We are a top-quartile venture firm with a proven track record spanning over a decade, recognized as one of the Most Innovative Companies by Fast Company in 2022 and a Top 20 Venture Firm by CB Insights in 2024. Our firm was founded in 2014 with a particular focus on individual accredited investors and a well-defined and rigorous approach to evaluating and selecting investment opportunities. With an emphasis on network-powered venture capital, fueled by a community of over 625K members, Alumni Ventures has invested in over 1,300 portfolio companies and established itself as the most active venture firm in the U.S. and the third most active venture capital firm worldwide, according to PitchBook’s 2022 and 2023 rankings.

Broad and diversified venture portfolios with community: Most venture investors to date have been institutions that could commit millions per venture firm and have the resources to invest in multiple venture firms. In contrast, AV provides accredited individuals with a venture portfolio for as little as $25K.

Deal access and flow: We offer investors access to a portfolio of highly competitive deals invested alongside other established venture firms. Our investment activity has made us the #1 most active venture firm in the U.S. according to PitchBook’s 2022 and 2023 rankings.

Risk management through large, diversified portfolios: Our funds provide diversification across stage, sector, geography, and lead investor. In addition, given venture’s power law characteristics (a few huge winners offset losers), larger venture portfolios tend to have better performance characteristics than smaller venture portfolios.5 Compare this to individuals who do an occasional one-off deal. For them, the likelihood of a substantial or complete loss of capital increases significantly.

Co-investing strategy: We invest alongside other established VCs with sector and/or stage expertise who lead the round and negotiate terms. Accessing promising venture deals is what our investment team of ~40 people is committed to delivering for you.

Community: AV leverages a network of 625,000+ subscribers and community members to source capital and deals, conduct due diligence, and assist portfolio companies. As our community grows daily, so does our commitment to investor engagement, education, and network sourcing.

(5) Steven Crossan, “Modelling Suggests Rational Venture Investors Should Have Bigger Portfolios,” April 11, 2018.

We have ~40 investment professionals across AV’s family of funds and our Office of Investing (or OOI), whose expertise is used to source and evaluate potential deals and balance portfolios. Our Office of Investing, under our CIO, helps coordinate deals, source, research, and execute deals. Each of our actively managed funds also has its own Investment Committee consisting of experienced investors and business executives.

Most of our Alumni Funds and Focused Funds are managed by a team of 3-4 full-time investment professionals per fund with strong investing and entrepreneurial experience. For each individual portfolio company being considered by a sponsor fund, investment decision-making is process-based, and the ultimate decision is a collective vote of the sponsor fund, the sponsor fund’s Investment Committee, and the AV Investment Committee.

Our Total Access Fund and Foundation Fund are managed by AV’s Office of Investing, with portfolios created from deals sourced and invested in by our Alumni Funds and Focused Funds.

You can see our Loyalty, Rewards, Performance, and Fees brochure here. Note that our Loyalty Program rewards investors for both early commitment of capital during a fundraising and for total commitment over time.

Our funds are only open to accredited investors. The SEC defines an accredited investor as someone who (a) has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR (b) has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence), OR (c) holds certain professional designations in good standing. Other methods of showing accreditation are available to entity investors. We partner with Parallel Markets. Further details are available here.

Investors can get a diversified professional-grade venture portfolio for as low as $25,000. Investment minimums vary by fund and circumstances. Check the fund’s respective subscription documents for details.