Professional-Grade Venture Portfolios

for individual investors.

Quality & Quantity Are Both Essential in Venture Investing

Alumni Ventures is recognized as a "Top 20 Venture Firm" by CB Insights ('24) and as the "#1 Most Active Venture Firm in the US" by Pitchbook ('22 & '23). We are America's Largest Venture Firm For Individual Investors.

$1.25B+

capital raised

1,300+

portfolio companies

625,000+

community members

10,000+

individual accredited investors

The Power of a Network

Venture capital has always been about connections and deal access. Our network, united by alumni connections and an interest in entrepreneurship, generates value via powerful flywheels.

Investor & Entrepreneur Testimonials

Real quotes from real community members.

See testimonial policy below.

Book a Private Intro Call

Quick & Easy. 15 Minutes.

Why VC May Belong in Your Portfolio

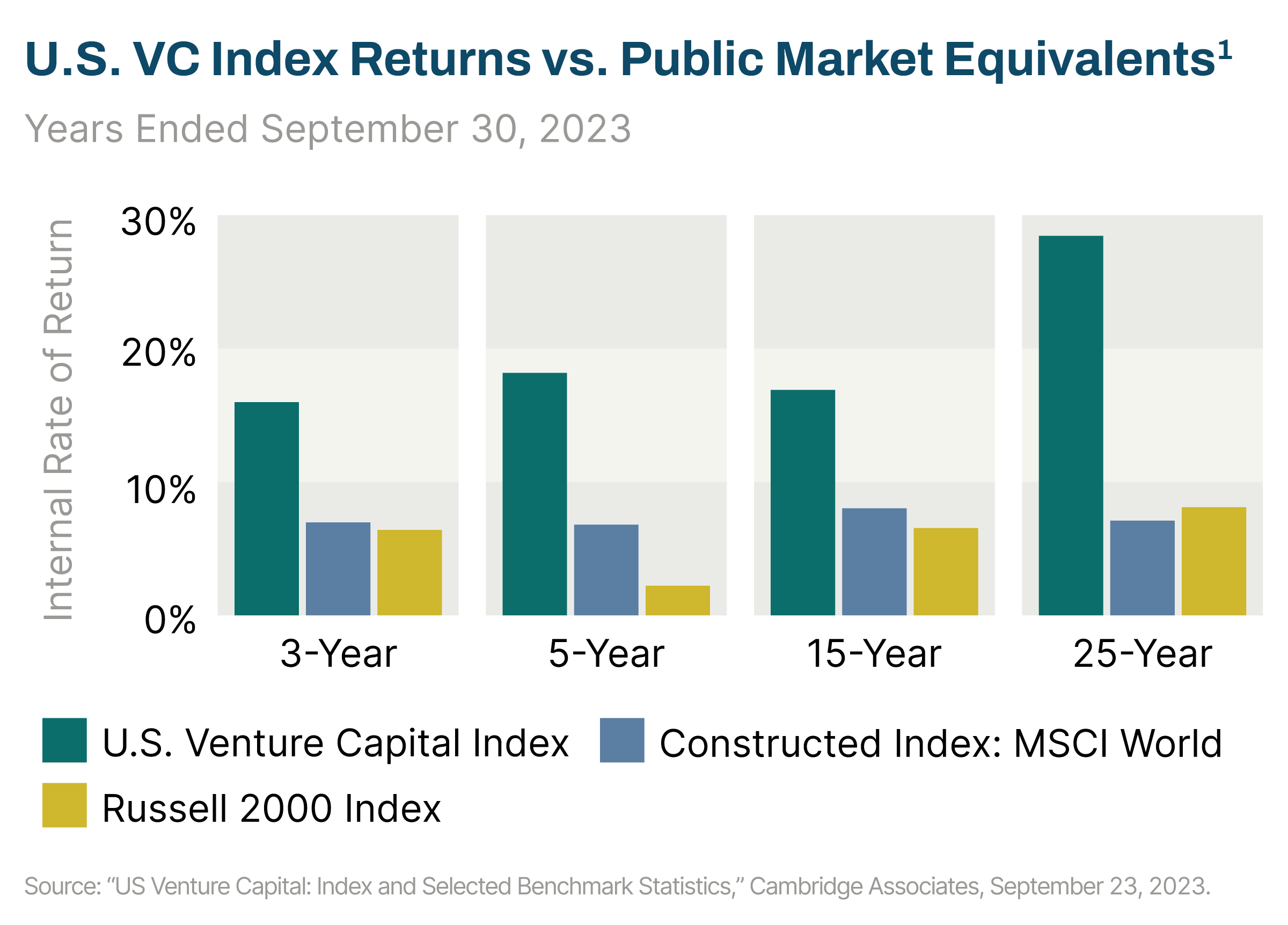

- HomeVC has outperformed the public market equivalents over the past 5, 15, and 25 years.

- HomeVC has been the top-performing alternative asset class over the last decade.

- HomeVC is largely uncorrelated to the public markets, making it attractive from a portfolio risk-mitigation perspective.

- HomeMore value is being created in the private markets than ever before, and the largest endowments and institutions are increasing allocations here.

Sources for the above claims

Learn About Our Powerful Network

Let’s create more value together.

For Accredited Investors

We are the venture partner for 10,000+ investors.

For Entrepreneurs

We are a co-investor whose network can help with connections, capital, and customers.