The Practical Value of Deep Tech Solutions

We highlight innovative portfolio companies offering practical deep tech solutions

It’s been a past criticism of some deep tech ventures that they’re a technology in search of a business model. However, Alumni Ventures carefully vets all companies in the portfolio for both size of opportunity and business model, as well as team, investors, and more. We highlight some innovative companies from our Deep Tech Fund portfolio that are offering practical solutions in their respective industries. Like our investors, we’re firmly focused on valuation and return potential, and believe these three ventures offer a compelling case.

Commitments to This Year’s Deep Tech Fund Due September 30

Alumni Ventures’ Deep Tech Fund offers a portfolio of ~20-30 diverse companies tackling the toughest and potentially most lucrative tech challenges. Recent events have underscored the critical importance of science and rational thought for the well-being of society and the planet.

To learn more, click below to review fund materials or make a commitment.

Chooch

Focus: Software that quickly identifies and tags visual data, creating AI models that can detect objects, actions, states, etc.

Co-Investors: Vickers Venture Partners, 212 Venture Capital, Streamlined

Why the Tech Is Needed

- Compelling utility and ease of use. Unlike single-purpose computer vision systems, Chooch Al can be quickly trained and deployed to recognize various objects, actions, and states.

- Great versatility. Uses for Chooch’s tech include workplace safety, satellite image analysis, operating room procedure detection, image quality control, shelf management, and much more.

- Inevitable market. The ability to train AI systems for visual analysis is becoming critical in all industries.

Ocient

Focus: Big data platform for rapid analysis of the world’s largest datasets.

Co-Investors: Greycroft, OCA Ventures, VCapital, Valor Equity, Pritzker Group, In-Q-Tel

Why the Tech Is Needed

- Substantial and hungry market. There’s compelling need for faster analysis of largest datasets constituting a $7.5B Active TAM that’s currently underserved by existing solutions.

- Broad customer applications. Ocient serves customers across network security, geospatial data, adtech, financial markets, and telecom.

- Compelling value proposition. Ocient offers massive scalability, disruptive speed (5-50X faster computer speed), best-in-industry cost of ownership, flexibility, and repaid productivity.

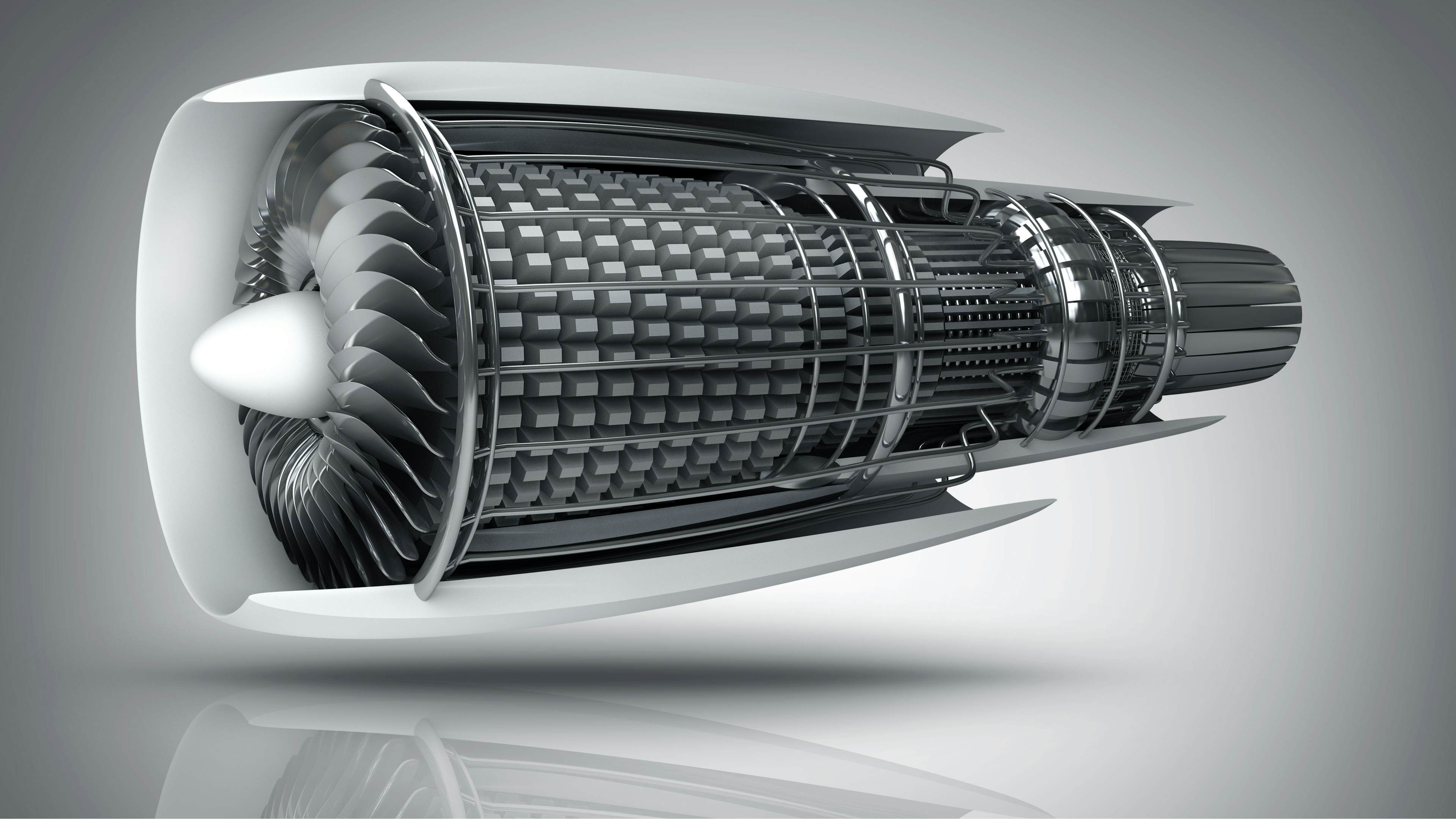

Ursa Major Technologies

Focus: A space technology company that makes turnkey propulsion engines for launch vehicles.

Co-Investors: Alpha Edison, Alsop Louie Partners, Arden Road Investments

Why the Tech Is Needed

- Growing industry. The space industry is already a $12B market and is expected to grow 10-20% annually, thanks to recent tech breakthroughs and the success of SpaceX and Blue Origin.

- Focus on vital component. Ox–rich combustion engines are highly efficient, which is important to improve the payload of rockets. Until recently, no American companies could make these, and it is Ursa Major’s sole focus: producing the best propulsion engines at low cost.

- Multiple segments. Ursa Major’s versatile engines have application for both commercial and national security launches.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.