Seeding the Future: Bandit ML

Our “Seeding the Future” series explores trends, opportunities, and companies from the seed and pre-seed venture world. This is the investment focus of AVG’s newest Basecamp Fund.

The fund is now open! Click below to learn more.

We’re pleased to announce one of the first investments made in AVG Basecamp Fund 2021: BanditML. This company will be included in your portfolio — plus ~100 other such investments — if you invest in the fund.

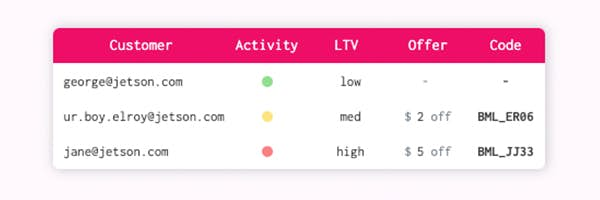

Every online shopper has encountered this: the attractive — or not so attractive — promotion or product recommendation that influences your purchase. BanditML’s SaaS platform more effectively optimizes those offers by using machine learning to develop personalized promotions on the individual customer level.

This kind of targeting is incredibly valuable to online merchants. The biggest merchants (Amazon, Uber, etc.) already employ sophisticated personalization and dynamic pricing. But until now, the 800,000 mid-cap and long-tail ecommerce merchants haven’t been able to afford the talent and tech to leverage these strategies.

Today, most merchants send promotions blindly without understanding the type, frequency, or level of promotion that will maximize conversion and dollars. Offering the same promotion to all customers leaves money on the table or doesn’t convert others. And with $180B spent every year by ecommerce merchants on non-optimized incentives, that’s a sizable miss.

A Solution for the Merchants Missing Out

Here’s how BanditML works for smaller merchants who’ve previously been unable to use personalized promotions:

- Customers visit the online merchant.

- BanditML draws on the merchant’s order history and the customer sign-up data sources.

- BanditML then trains and deploys a model to develop individual promotional offers that are optimized to maximize that customer’s conversion.

- Through BanditML’s platform integrations and API, these offers are then plugged directly into the merchants CRM channels, and campaigns are managed end to end by BanditML.

These optimized models result in a net revenue increase of between 1.3% – 20% on promotional campaigns for merchant customers. The company prices its monthly service fee for access to its platform based on transaction volume at ~10% of the net revenue increase they predict they will unlock for merchants. Thus the value proposition to merchants equates to ~10x ROI on BanditML’s service fee.

The company’s first product is focused exclusively on promotional pricing strategies. However, their vision is to develop a holistic platform that evaluates and optimizes all variables in a company’s pricing strategy to personalize pricing strategies on the individual customer level.

About the Deal

We participated in BanditML’s first round of significant funding. A recent graduate of Y Combinator’s S20 cohort, BanditML is also backed by an excellent syndicate of early stage investors and numerous highly relevant and well-pedigreed angel investors with deep domain expertise/networks. Participants included Haystack, backer of DoorDash ($16B), Instacart ($13.8B), and Opendoor ($3.8B). Other investors included Liquid 2 Ventures (13 exits), Jigsaw VC, and several notable angels who were former executives at Uber, Uber Eats, and DoorDash.

Deal Highlights

- Team with the Right Tech Experience: BanditML’s three-member team consists of highly technical engineers with experience in applied AI at Uber, Twitter, and Facebook. The team’s experience developing Uber’s surge pricing algorithm is directly applicable to BanditML’s business.

- High Capital Efficiency: The team has demonstrated creative and disciplined cash management. Further, with the team’s highly technical and functionally complementary skills, they already have all the core product and engineering in house and will be able to operate with high capital efficiency going forward.

- Rapid Traction: Since launching, BanditML has been able to scale MRR via promotions running through their platform. This is a strong signal of product-market fit and an indication that the company is onto something.

- Attractive Valuation: This round was well priced for the early stage market in general and very conservatively priced for a Y Combinator company.

- Strong Syndicate: Haystack and Liquid2 are leading institutional early investors. When combined with the pedigreed angels (ex CPO Uber, ex VP Product Uber / Twitter, Founder / CTO TellApart), the investor syndicate is highly compelling.

AVG’s Basecamp Fund offers investors a portfolio of ~100 pre-seed and seed investments diversified across sector and region. Approximately 25% of the fund is reserved for follow-on investments. Minimum starts at $25K. The fund is now open! Click below to learn more.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.