AVG Portfolio Companies Doing Timely Work

The world is experiencing a “Perfect Storm” crisis: a pandemic, likely worldwide recession, and an extreme level of both personal and societal fear — all reinforced in a vicious spiral. Add to this the 2020 speed of information (and disinformation) sharing that amplifies and accelerates the sense of panic.

VENTURE VERSUS THE VIRUS

In times like this, we all need to hear — and share — constructive news about work being done to tackle problems caused by COVID-19. Here’s what some AVG portfolio companies are contributing.

But as the CEO of venture capital firm Alumni Ventures Group, I’m fortunate to encounter on a daily basis entrepreneurs and their companies who are wired to tackle problems like this. My firm reviews and invests in a tremendous number of deals. Per Pitchbook, we’re the seventh most active VC in the world, third in the U.S. The amazing entrepreneurship, innovation, and problem-solving chops of the 434 companies in our portfolio give me great hope. I want to share some of that good news.

First, for those less familiar with venture capital, here’s how it works for us. AVG invites accredited investors to commit capital to one of our funds. Then we take that capital and invest it in promising private growth companies across a variety of industries, stages, and regions. In essence, we own a little piece of those companies — which we and our investors hope and expect will grow in value and eventually profitably exit through a merger/acquisition or by going public.

That’s the economics of the business. The social impact is another story. While by no means do all of our companies tackle coronavirus directly, we’ve been gratified by the number that are helping and excited by the entrepreneurial spirit they are all showing. It’s business as usual for nobody.

The Detection of COVID-19

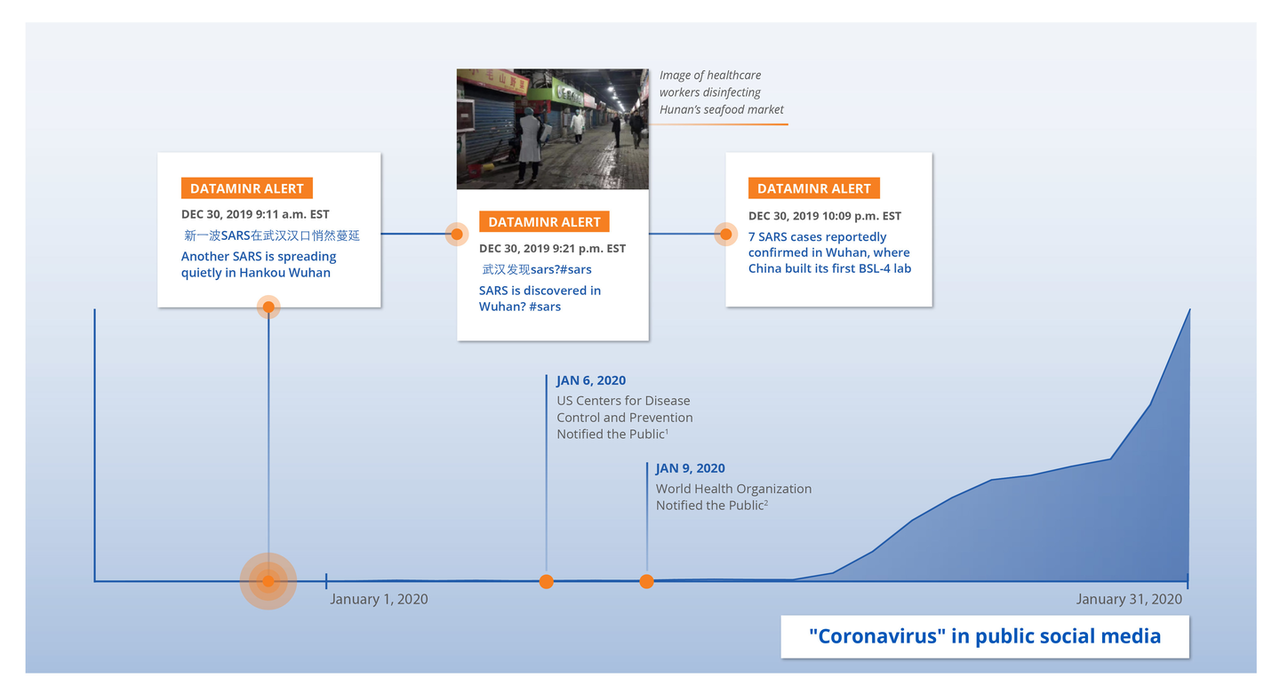

Let’s start with risk detection. Dataminr, an AVG portfolio company, is an AI platform designed to identify early, weak data for risk assessment. The company was among the first to pick up traces of coronavirus. On a less technical side, AVG has a community of 500,000 subscribers and community members — many very well connected — who were giving us an early heads up on events in China.

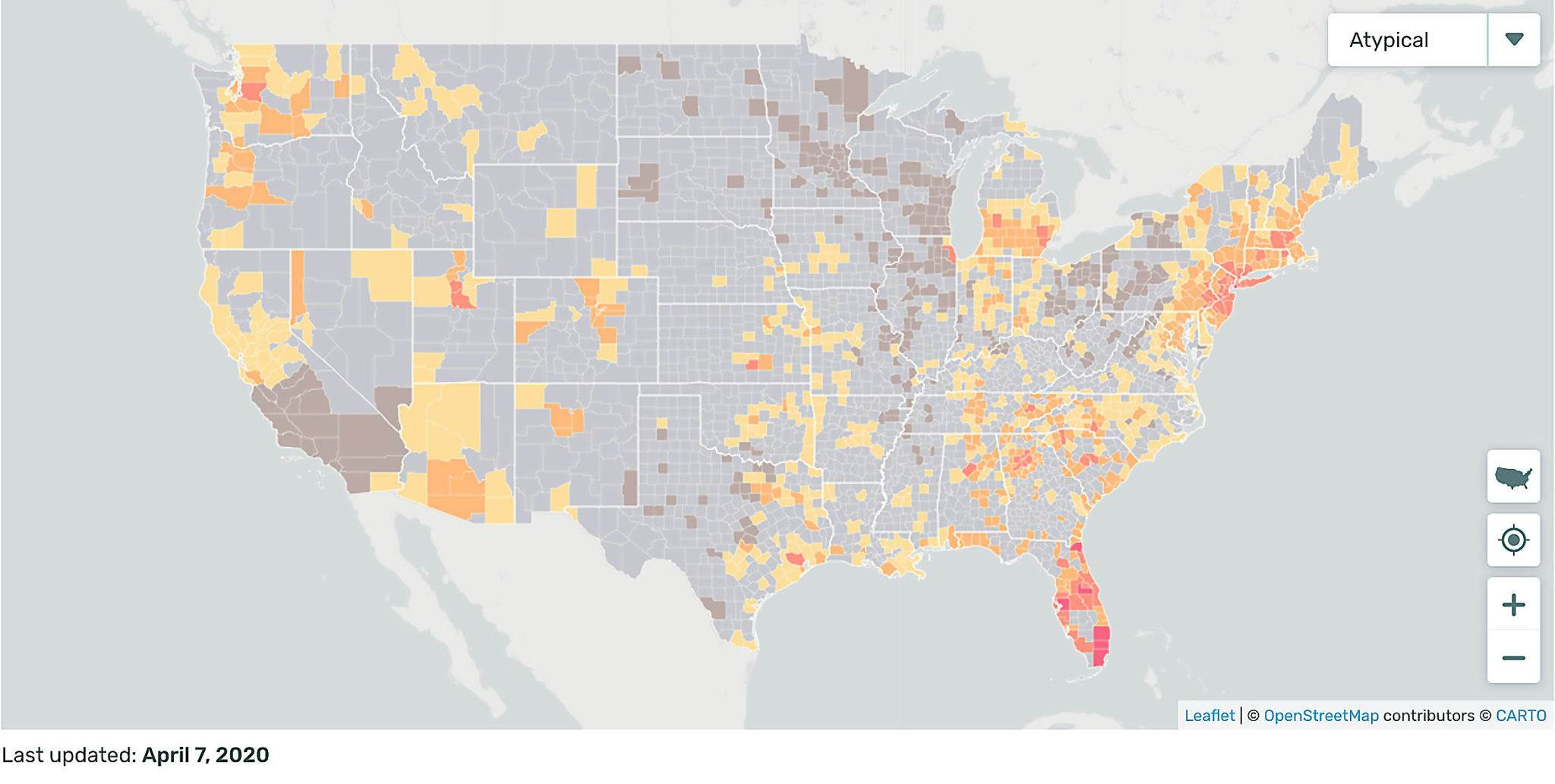

Another early contributor in the coronavirus battle has been Kinsa. Their smart, cloud-connected thermometers and data analytics may be THE solution to help us track the virus and thus be much more equipped to respond. Kinsa was the first to point out the Spring Break/Florida problem. The impact of their data was recently featured in the New York Times: Restrictions Are Slowing Coronavirus Infections, New Data Suggest.

Tests and Care

The list continues with companies focused on tests and cures.E25Bio recently raised funding to develop improved testing. Celularity is working to develop a cellular therapy treatment. COVID-19 vaccines are being run through supercomputer simulations, greatly shortening the potential time to market. Quantum computing company Rigetti is building tech that offers magnitudes faster processing that could be part of the solution — probably not for this crisis, but hopefully the next one.

Others in our portfolio are tackling care. Brave Care and SonderMind are quickly adapting to provide resources and telehealth services for their customers. Demand for Heal and Tembo Health is spiking as their telehealth and home visit models are exactly what so many of the socially distanced and nursing homes need right now. Respiratory Motion’s ExSpiron product improves patient and caregiver safety in ventilation monitoring.

Addressing Today’s Problems

Even companies positioned in depressed industries such as hospitality are innovators who are likely to weather the storm. Take a look at our portfolio company Zeus, an innovator in corporate housing (an alternative to extended-stay hotels). And even as restaurants shutter, our food subscription Freshly keeps delivering fresh meals right to your door.

Navigating the Challenges

As frightening as the world may be right now, we at AVG find comfort in being surrounded by over 434 entrepreneurs and their teams who are helping us navigate the changes. Certainly both AVG and our investors are clear-eyed in recognizing the challenges facing all companies and the reality that some may not make it. However, we admire and are betting on the ingenuity and resolve of our entrepreneurs, who view this obstacle as a challenge to be conquered.

And both AVG and its investors remain committed to the value, both financial and societal, in venture — even in these turbulent markets. Experienced VCs know that in the cauldron of hard times, valuations are lower, deals are easier to get into, and great companies are founded (for examples, look at the founding stories of Google, Uber, Airbnb, Square, Slack, Beyond Meat, Pinterest, WhatsApp). In just the last few weeks, AVG invested in seven new deals and signed up our 3,952th investor.

I’m grateful to be a witness and small contributor to the continuing good work from our venture companies. It’s left me convinced that in the battle of Venture vs. the Virus, COVID-19 will lose. It’s just a matter of time.

ABOUT THE AUTHOR

Mike Collins

CEO of Alumni Ventures GroupMike Collins, CEO of Alumni Ventures Group, has been involved in almost every facet of venturing, from angel investing to venture capital, new business and product launches, and innovation consulting. He launched AVG’s first alumni fund, Green D Ventures, where he oversaw the portfolio as Managing Partner and is now Managing Partner Emeritus. Mike is a serial entrepreneur who has started multiple companies, including Kid Galaxy, Big Idea Group (partially owned by WPP), and RDM. He began his career at VC firm TA Associates firm. He holds an undergraduate degree in Engineering Science from Dartmouth and an MBA from Harvard Business School.